“Cryptographic market insights: decentralized Börsen (Dexs), liquidity pools and market volumes”

In recent years, the cryptocurrency world has been innovations in innovation due to technological progress and increasing introduction by investors worldwide. Two components of the cryptolium scenario are decentralized values (Dexs) and liquidity pools that significantly influenced the dynamics of the market. In this article, we will deal with the concept of these two technologies, their advantages and the way they contribute to the entire cryptocurrency ecosystem.

Decentralized Change (Dexs)

A DEX is a blockchain -based platform with which users can exchange cryptocurrencies without intermediates and conventional values. In contrast to centralized stock exchanges they have and manage large amounts of customer funds, Dexs works with the base point base so that resellers can buy and sell actives directly from each other.

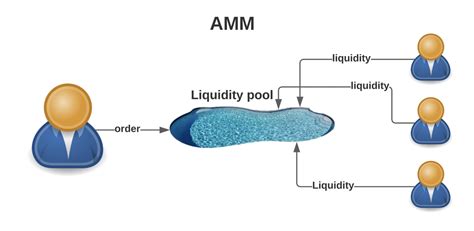

Dexs are designed to offer faster transaction times, lower rates, and greater security than conventional value bags. They also offer more flexibility in terms of active selection and trade strategies, as users can exchange multiple cryptocurrencies at the same time. In addition, Dexs usually use advanced technologies such as liquidity pools and market manufacturing to facilitate business and maintain market order.

Liquidity Pools

A liquidity pool is a decentralized exchange platform with which dealers can perform other loans or lend them to others to buy them or sell them in the network. This concept was created by the pioneering work of Makerdao, which created a stable decentralized currency called DAI (US dollar dollars accredited). The Makerdao Protocol uses a combination of gain agriculture and liquidity determination to create a net market for different cryptocurrencies.

Liquidity pools can be used for central and limited orders so that resellers can absorb or sell assets at applicable market prices. This function has significantly improved the commercial efficiency of users and reduced the deviation (deceleration) associated with conventional stock exchanges.

Market volume

Market volumes are related to the total value of the value, which is negotiated in a cryptocurrency exchange for a certain period of time. These numbers offer valuable information about the liquidity and feeling of different markets. Market volume data can be used by dealers and market analysts to identify trends, predict price movements, and optimize business strategies.

The growing introduction of Dex has led to significant growth in market volumes. Some stock exchanges reported daily commercial volumes with more than $ 1 billion. The settlement.

Future Effects and Perspectives

The combination of decentralized stock exchanges, liquidity sets and market volumes shapes the future of cryptocurrency markets. These technologies have the potential:

- Improvement of liquidity : By reducing sliding and increasing the efficiency of commercial execution, these platforms can help keep ordering books and reduce price volatility.

- Increase adoption

: user -feasible and lower rates related to dexs and liquidity pools control conventional interest in the negotiation of cryptocurrencies.

- Improvement of market feelings : Market volume data provides valuable information about market mood and allow dealers to make better founded investment decisions.

While the cryptographic scenario is developing, we will probably see more innovations in these areas, which leads to an increase in the introduction, growth and complexity of markets.

Diploma

Cryptographic market insights are of crucial importance to every investor who wants to sail the complex world of cryptocurrency trade. Understanding the concepts of decentralized exchange, liquidity sets and market volumes can help you make better founded investment decisions and maximize your potential returns.

ethereum mining normal duplicate