“Layering the Truth: Unpacking Crypto’s Layer 1, Lido’s Role in the Metaverse, and the Dangers of FUD”

As the cryptocurrency space continues to boom, new players are entering the fray, while others are perpetuating misinformation and fueling fear and doubt. Two key concepts that have gained significant attention in recent times are Layer 1 (L1) technology and Lido (LDO), which hold immense potential for the future of decentralized finance.

Layer 1: The Foundation of Blockchain

Layer 1 refers to the underlying infrastructure that enables blockchain technology to function, layering the security, scalability, and usability of blockchain networks. It’s the foundation upon which all other layers are built, including smart contracts, decentralized applications (dApps), and the user interfaces that allow users to interact with their respective platforms.

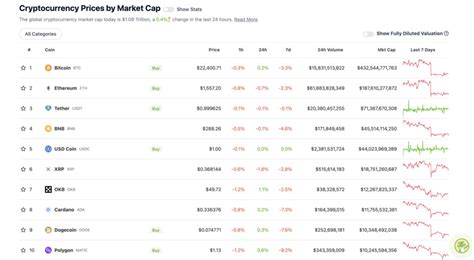

In the context of cryptocurrency, Layer 1 refers to Bitcoin (BTC) as the primary store of value and a widely accepted means of payment. Other cryptocurrencies, such as Ethereum (ETH), Polkadot (DOT), and Solana (SOL), build upon or compete with Layer 1 to create new use cases and applications.

Lido: The Decentralized Lending Platform

Lido is an open-source, decentralized lending platform that utilizes a unique approach to managing liquidity for various cryptocurrencies. By providing a user-friendly interface for users to deposit their assets into a pool of collateralized loans, Lido enables the creation of a robust and scalable lending ecosystem.

One of the key features of Lido is its ability to handle large volumes of assets without relying on centralized exchanges or other intermediaries. This not only increases liquidity but also reduces fees associated with traditional lending platforms. Additionally, Lido’s tokenomics (the economics of a particular cryptocurrency) ensure that it remains decentralized and free from manipulation.

The Dark Side: FUD and the Spread of Misinformation

FUD stands for Fear, Uncertainty, and Doubt, which has been employed by some investors to manipulate market sentiment around cryptocurrencies. By spreading false or misleading information, these individuals seek to drive down the price of a particular asset, ultimately profiting from the resulting drop.

In the case of Lido, FUD has taken on a more insidious form, as some critics have accused the platform’s developers and advisors of promoting the use of “centralized” lending platforms that favor traditional financial institutions over decentralized alternatives. While it is true that some centralization exists in the cryptocurrency space, it is essential to recognize that Lido’s primary goal is to provide a more accessible and user-friendly experience for users.

The Future: Layer 2 Innovations and the Rise of Decentralized Finance

As we move forward, Layer 1 technology will continue to play an increasingly vital role in shaping the future of cryptocurrency. In particular, innovations on top of L1 platforms like Ethereum are expected to drive the growth of decentralized finance (DeFi) applications.

Layer 2 technologies, such as Optimism and Polygon’s scalability solutions, promise to improve the usability and performance of DeFi protocols, making them more accessible to a wider range of users. As these platforms continue to mature, we can expect to see significant advancements in the field of cryptocurrency and the development of new use cases that will propel the industry forward.

Conclusion

In conclusion, Lido represents an exciting opportunity for the decentralized finance space, offering a unique approach to managing liquidity and providing access to a wide range of cryptocurrencies. By understanding the fundamentals of Layer 1 technology and the role of platforms like Lido in shaping the future of cryptocurrency, we can better navigate the complex landscape of this rapidly evolving industry.