The double blow of short positions and price stocks in decentralized finances

Decentralized Finance (Defi) has gained popularity in recent years, with its innovative models, cutting -edge technology and growing community. However, Defi also comes with a number of risks, including short positions that can have devastating consequences. In this article, we will explore the concept of short positions, price stocks and their potential dangers in Defi.

What is a short position?

A short position is an investment strategy in which you lend a certain amount of assets (for example, tokens, cryptocurrencies) with the expectation of buying them back at a lower price later. If the price falls, you can sell your assets borrowed to make a profit. However, if the price rises, you will keep useless or severely undervalued assets.

Price stocks in Defi

Price stocks refer to fluctuations in asset prices over time. In defi, price stocks are often driven by market sentiment, regulatory changes and other external factors. For example:

* Pump and dumping schemes

: Price increases can be orchestrated through pump and dumping schemes, where an individual or group artificially inflates the price of a token to sell it at the top, leaving investors with losses significant.

* Market manipulation : Regulators can try to manipulate market prices by buying or selling assets in ways that create artificial trends. This can lead to pricing volatility and instability.

The risks of short positions in define

Short positions are particularly dangerous in Defi due to the following risks:

* Liquidity risks : If the value of a borrowed asset decreases, you can fight to sell it back with profit, leading to significant losses.

* Risks of counterpart : The counterparts involved in short positions can fail or become insolvent, exposing investors to possible liabilities.

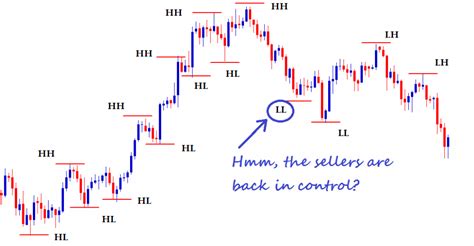

* Market volatility : Short positions can amplify price movements, making them more volatile and unpredictable.

Price stocks and short positions

Price stocks can exacerbate the risks of short position by:

* Amplification of price moldes : Price increases can make it difficult to make profits in their short position.

* Creating market feelings : Pump and market dumping or market manipulation can create false confidence, boosting higher prices, even when underlying assets are not good.

Mitigating Risks: Best Practices

To minimize the risks when using platforms defi:

- Perform complete research : Understand the platform, its underlying technology and any potential risks.

- Use margin protection : Use margin protection mechanisms to limit your losses in case of significant price fluctuations.

- Diversify your investments : Spread your investments in various assets to reduce dependence on a single or active token.

- Stay informed : Keep updated with market news, regulatory developments and any potential risks associated with defi platforms.

Conclusion

Financial decentralized offers interesting opportunities for investors, but it is essential to be aware of the risks involved in short positions and price stocks. By understanding these concepts and taking into consideration the best practices, you can minimize your exposure to possible losses and browse the defi world with confidence.