The Art of Crypto Risk Assessment: A Guide to Navigating the Digital Market

In the world of cryptocurrency, risk assessment is a critical component that separates savvy investors from amateur traders. Cryptocurrencies have experienced significant volatility in recent years, making it essential to understand how to evaluate the risks associated with investing in this space.

Understanding Risk Assessment

Risk assessment is the process of identifying potential threats and consequences that could impact an investment’s value or performance. In crypto, risk assessment involves analyzing various factors such as market trends, regulatory environments, technological advancements, and market sentiment to predict potential outcomes.

To develop a comprehensive risk assessment strategy, it’s essential to consider the following key areas:

- Market Volatility: Cryptocurrency prices can fluctuate significantly in a short period, making it challenging to predict future price movements.

- Regulatory Environment: Changes in government policies or regulations can significantly impact cryptocurrency markets and investor confidence.

- Technological Advancements: New technologies can disrupt the market, creating opportunities for investors to capitalize on emerging trends.

- Security Risks: The use of smart contracts and decentralized exchanges (DEXs) increases the risk of security breaches and theft.

Mnemonic Systems: A Simple yet Effective Tool

A mnemonic system is a mental aid that helps individuals remember complex information, such as passwords or investment strategies. In crypto, mnemonic systems can be used to store sensitive data, such as private keys or seed phrases, in an easily accessible location.

One popular mnemonic system for storing cryptocurrency addresses and private keys is the “mnemonic method”. This involves creating a unique phrase that associates with specific cryptocurrencies or assets. For example:

- Bitcoin: “Hearts Are Free”

- Ethereum: “Hug The Earth”

By associating each cryptocurrency with a memorable phrase, users can more easily recall their private keys or seed phrases.

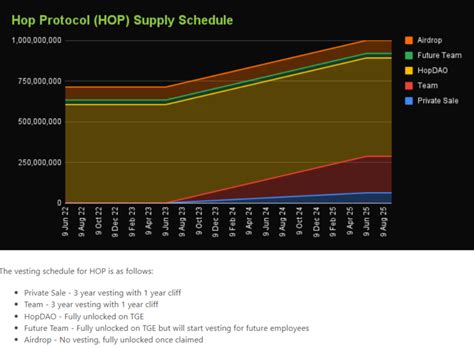

Vesting Periods: A Crucial Consideration

A vesting period is the timeframe during which an investor’s investment or ownership stake in a cryptocurrency gradually increases over time. This allows for a gradual allocation of funds to riskier assets as they become less volatile, while minimizing exposure to extreme market fluctuations.

In crypto, vesting periods can range from 5-10 years, with some popular examples including:

- Bitcoin: 2-year vesting period

- Ethereum: 3-year vesting period

- Tokenomics-based cryptocurrencies (e.g., Cardano): 4.5-year vesting period

By understanding the concept of vesting and how it applies to individual cryptocurrency investments, investors can make more informed decisions about their portfolio allocation.

Best Practices for Crypto Risk Assessment

To maximize your crypto investment strategy, consider the following best practices:

- Diversification

: Spread your investments across multiple cryptocurrencies to minimize risk.

- Long-term Focus: Hold onto your investments for extended periods, rather than trying to time the market or make quick profits.

- Risk Management

: Set stop-loss orders and position sizing guidelines to manage potential losses.

- Research and Due Diligence: Thoroughly research each cryptocurrency before investing in it.

By incorporating these concepts into your crypto risk assessment strategy, you’ll be better equipped to navigate the digital market and make informed investment decisions.

Conclusion

Crypto risk assessment is a complex topic that requires attention to detail, thorough understanding of market trends and regulations, and effective use of mnemonic systems.